(Bloomberg) — LG Electronics Inc. is issuing bonds in US dollars to help the South Korean appliance manufacturer finance sustainable projects, marking its inaugural issuance for this purpose.

The company has revealed a two-part investment-grade debt deal that includes a named bond overnight, according to a source familiar with the situation. The longer term of the offering, a five-year sustainability security, is expected to produce a return 1.1 percentage point higher than Treasuries, following initial discussions of around 1.5 percentage points, as stated by the source, who requested anonymity due to the private nature of the details.

LG Electronics intends to utilize proceeds from the sustainability portion to support eligible green and social projects such as the installation of energy-efficient electronic devices, eco-friendly construction, and the provision of essential services to socially vulnerable groups such as youths with disabilities, as outlined in its sustainable finance framework released in January.

Banks began promoting the deal to fixed income investors last week. If successful, it will mark the company’s first ESG-labeled bond in global markets, according to Bloomberg's compiled data. LG Electronics has previously turned to local markets to finance green projects.

Moody’s Ratings assigned a Baa2 rating to the proposed senior unsecured notes, its second lowest high-grade assessment, earlier this month. LG Electronics' strong credit profile, diverse product portfolio, and its “sound leverage” offset its “moderate profitability resulting from intense competition and current sluggish consumer demand,” analyst Sean Hwang wrote in a note.

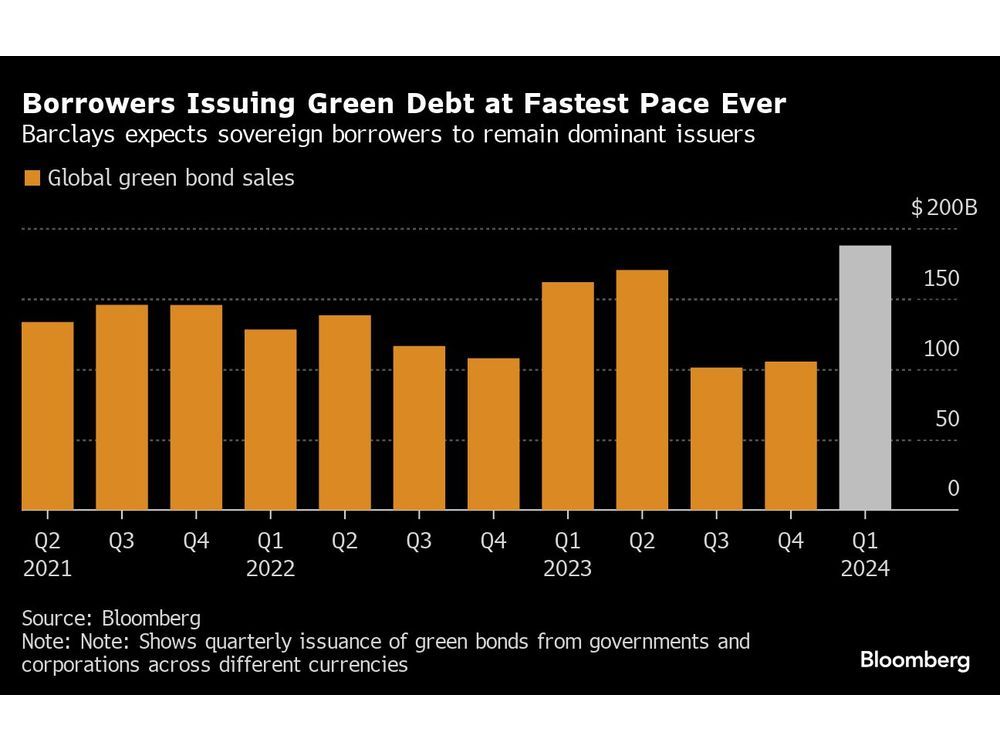

Companies around the world are hurrying to issue various bonds in the US investment-grade market due to robust investor demand and relatively narrow spreads. Issuance this year through Wednesday has reached a record $598.6 billion, according to Bloomberg's data. This surge in debt is contributing to a global surge in green bonds.

Read more: Green-Bond Issuance Reaches $188 Billion in Blockbuster Quarter

Established in 1958 and the largest shareholder of LG Corp., LG Electronics is exploring expansion into EV charging and digital health among other business sectors, in line with its framework. The Seoul, South Korea-based company manufactures household appliances, electronic products, and automotive components, and had a workforce of over 33,000 as of June 30.

A consortium of banks including BNP Paribas SA, Citigroup Inc., HSBC Holdings Plc and JPMorgan Chase & Co. are overseeing the bond sale, the source said.

—With assistance from Ameya Karve, Kyungji Cho and Jiayu Liu.