(Bloomberg) — Nigeria’s new massive Dangote oil refinery is gradually starting to operate, and experts and traders are closely monitoring its progress to determine when it will begin supplying gasoline to the market.

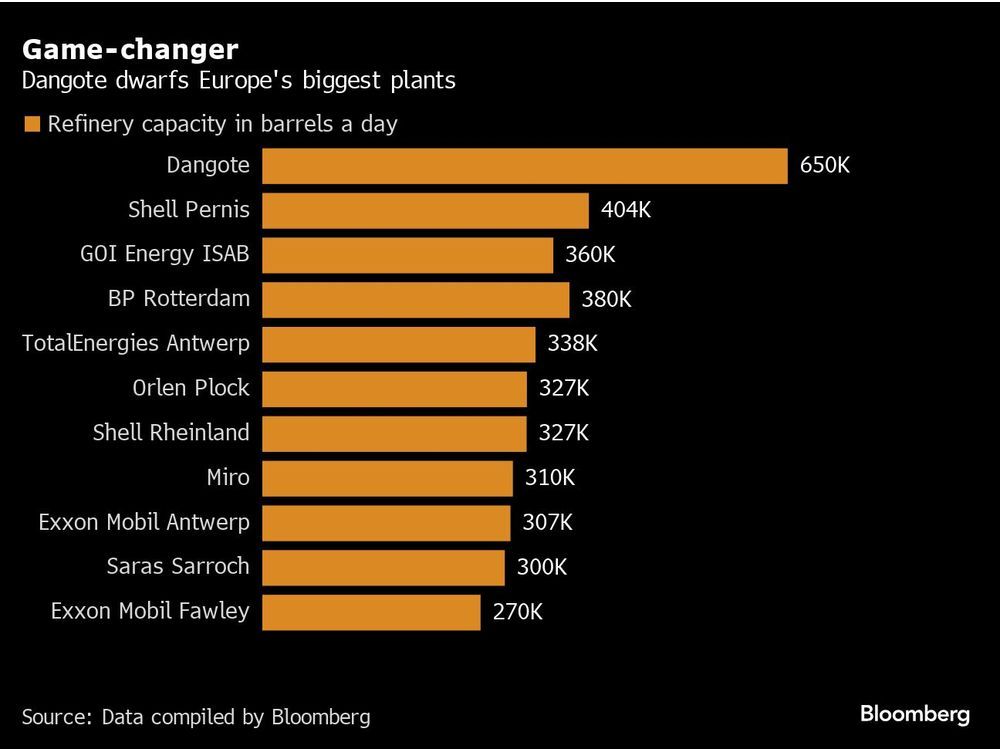

The 650,000 barrel-a-day Dangote plant outside Lagos is leveraging cheaper US oil imports for up to one-third of its raw material as it commences operations. It has been transporting products in recent weeks while preparing two units to facilitate gasoline production, which is expected to bring significant changes to the fuel market in Nigeria and the region, according to analysts.

“Dangote is going to impact the Atlantic Basin gasoline markets in the upcoming months and for the rest of the year,” said Alan Gelder, vice president of refining, chemicals, and oil markets at consultancy Wood Mackenzie. “When the RFCC becomes operational, it will substantially alter the supply balance of West African gasoline,” he said, referring to a unit that upgrades heavier products.

The refinery is currently operating at approximately 300,000 barrels per day, nearly half of its maximum capacity, based on the average estimate of analysts at WoodMac, FGE, and Citac. The complex has commenced shipments of jet fuel, gasoil, and naphtha as it expands its range of products.

Wood Mackenzie anticipates that the units focused on gasoline production will be operational this summer, while other analysts project that the RFCC may take until the end of the year. Dangote Industries announced earlier this month that gasoline deliveries will commence in May. A company spokesperson did not immediately respond to inquiries.

“The refinery is already significantly affecting product markets even while operating at minimal rates,” said Ronan Hodgson, an energy analyst at FGE. Units that enhance diesel quality will also start operating in the coming months.

Up to one-third of the oil delivered to the enormous refinery so far has been US grade WTI Midland, according to shipping information compiled by Bloomberg. This trend is likely to continue as long as foreign oil remains cheaper than local supplies, Hodgson noted.

Dangote could potentially change that. Nigeria introduced new regulations earlier this week that will require its oil producers to sell crude to domestic refineries in an effort to reduce the country’s dependence on imported refined products. It is not yet clear how much each refinery will be required to acquire.

—With assistance from Nduka Orjinmo and Rachel Graham.