After one mother ended up in a lot of debt, she is determined to give her children money management skills by making them pay rent, which has sparked some controversy.

Samantha Bird, 30, wants to prepare her children for adult life by having Simon, Jonah and Asher, who are nine, eight, and six, to pay 'pretend bills.'

But they don't actually have to use their own money.

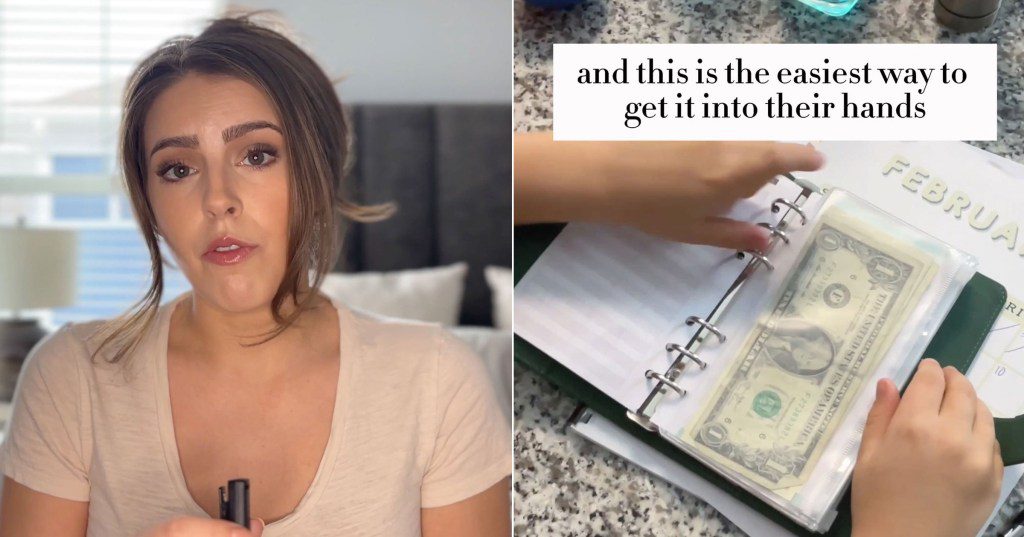

They receive an allowance of $6 each week, and $1 goes toward their expenses, $1 for food, and $1 for utilities.

They get the money in exchange for doing their chores during the week. Their tasks are tracked in special workbooks and divided into earning, saving, spending, giving, investing, and expenses.

‘Every week, we sit down with the boys to review their finances, go through their workbooks and wallets, and teach them a financial skill,’ explains Samantha, who lives in Holland, Michigan.

‘We charge rent to our children for a couple of reasons. I want them to understand how to control their money and learn to manage their expenses.’

Motivated to share her method with other parents, she recently posted a video on TikTok that was viewed over seven million times.

While some parents have been encouraged by Samantha’s approach, not everyone has reacted positively to the advice.

‘Just let kids be kids!,’ wrote one user on TikTok, while another added: ‘They’re too young to be doing this kind of thing, just let them be children.’

Samantha spent ‘years’ trying to sort out her finances and now aims to pass on her improved financial knowledge to her children in an enjoyable, accessible way.

‘My husband and I ended up in a lot of debt and were not financially secure,’ she shares.

‘It took us a long time to get our financial situation sorted and climb out of the hole we were in.

‘Because of this, I really wanted to make sure that my kids could avoid as much of that as possible.’

Now, they have a ‘money date’ with their children once a week, where they review their workbooks and wallets, learn a financial skill, and receive their weekly allowances.

‘Many parents have told me they plan to try it with their kids or wish their own parents had taught them similar things,’ Samantha concludes.

‘It’s fantastic to see so many parents investing in their children’s financial future.’

Do you have a story to share?