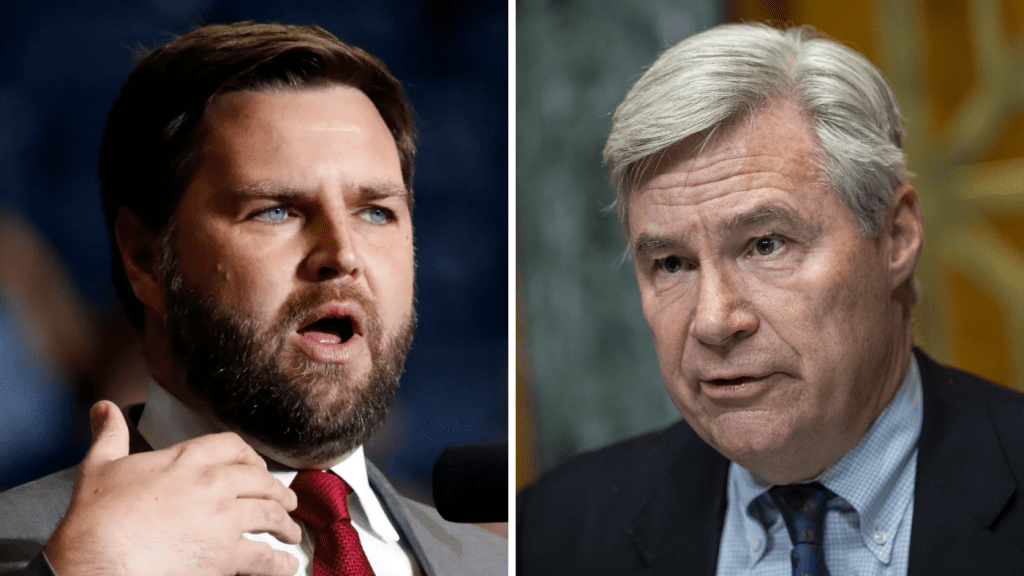

Sen. J.D. Vance (R-Ohio), a rising conservative figure aligned with Trump, and Sen. Sheldon Whitehouse (D-R.I.), a prominent liberal advocate for addressing climate change, have joined forces to end tax breaks for corporate consolidation.

Vance and Whitehouse have introduced the Stop Subsidizing Mergers Act, which aims to terminate the tax-free treatment for corporate mergers and acquisitions involving firms with average annual gross receipts of over $500 million across three years.

They presented the bill in response to the significant increase in major corporate mergers, which has nearly doubled in the past decade.

According to the bill’s sponsors, under current law, if a corporate merger is organized so that the acquiring company does so by exchanging stock, the increase in value of the company being acquired is often considered exempt from taxation. This allows shareholders to avoid taxes on the appreciation of the acquired company’s value at the time of sale.

Under their proposal, shareholders who experience an increase in the value of their holdings in all-stock mergers would pay taxes on the gains they receive from the merger instead of waiting until they sell the new shares to pay taxes.

In practice, Vance and Whitehouse argue that corporations and shareholders can avoid paying taxes by continuously postponing their obligations to the federal government.

“Large corporate mergers often fail to deliver their promised benefits but frequently leave American workers and families at a disadvantage. It’s time to close the unjust loopholes that enable these deals to avoid tax responsibilities. This sensible and bipartisan legislation will ensure that our nation’s largest corporations are held to a fair standard while preserving protections for small businesses to grow,” Vance said in a statement.

Whitehouse stated that their bipartisan bill will put an end to a substantial tax giveaway for massive corporate mergers and remove government support for corporate consolidation.

He contended that the record number of major corporate mergers has resulted in an anti-competitive economic environment.

“The families who end up paying higher prices as a result of these mega-mergers should not also have to cover the tax bill for them,” he stated.

The senators stated that 40 percent of U.S. corporate mergers by aggregate value since 2007 have been structured as stock exchanges.

They highlighted that in 2021, over half of the mergers over $1 billion were exempt from taxes.

They referenced significant examples such as Facebook’s $19 billion acquisition of WhatsApp in 2014, AT&T’s $85 billion acquisition of Time Warner in 2018, and Capital One’s $35 billion acquisition of Discover.