The financial forecast for Medicare got better in the last year, and the program’s money to pay for all the expenses for hospital services of older and disabled beneficiaries won’t be used up until 2036, which is five years later than last year’s expected date.

A more robust than anticipated economy and reduced spending on services like inpatient hospital and home health resulted in the unexpected positive news for Medicare. The report also attributed the good news to a policy change that decreased Medicare Advantage spending.

Just two years ago, the trust fund was estimated to be used up as early as 2028.

Once the program’s reserves are depleted, it would only be able to cover 89 percent of scheduled benefits, according to the annual report from Social Security and Medicare trustees released Monday.

“We are committed to steps that would protect and strengthen these programs that Americans rely on for a secure retirement,” Treasury Secretary Janet Yellen said in a statement.

In 2023, income to the hospital trust fund exceeded expenditures by $12.2 billion. The Trustees projected that surpluses would continue through 2029, followed by deficits thereafter until the trust fund becomes depleted in 2036.

Despite the short-term good news, Medicare’s costs will have to be dealt with by Congress at some point. Medicare provided health insurance coverage to more than 66 million people in 2023, and the program’s spending is going to continue to rise.

For the trust fund to remain solvent, the trustees said the standard 2.9 percent payroll tax could be immediately raised to 3.25 percent, or Medicare’s hospital benefits could be immediately cut by 8 percent. The changes could be more drastic if they are phased in over a longer period.

“The sooner solutions are enacted, the more flexible and gradual they can be,” the report noted. “Lawmakers have many options to address the long-range financial imbalance.”

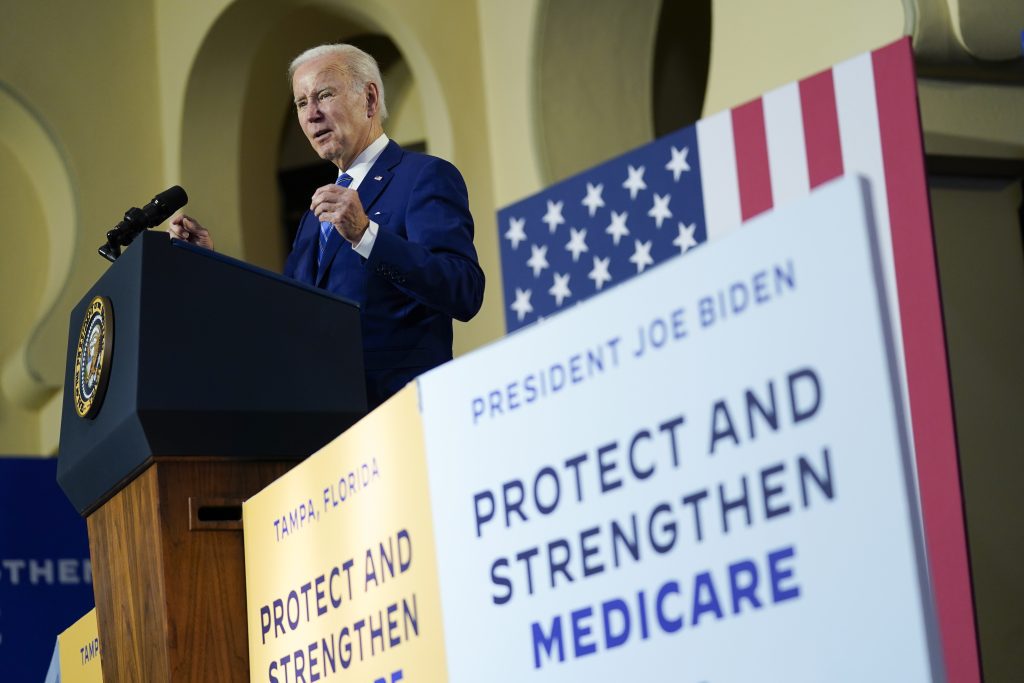

But changes to either Social Security or Medicare are a political third rail. President Biden has pledged to block any efforts to cut benefits and has called for higher taxes on the wealthy to shore up the programs.

Former President Trump, the presumptive GOP nominee, earlier this year hinted at potential cuts to entitlements to address long-term solvency issues, but later walked back his comments amid criticism from the White House.