(Bloomberg) — The worldwide diesel market is getting worse, which is worrisome for the economy and something for optimistic oil traders to think about.

In Europe, the US, and Asia, futures markets have dropped into contango, where immediate prices don't have premiums. This is generally seen as a sign of weakness.

Tamas Varga, an analyst at brokerage PVM, said, “The physical market is genuinely weak, as shown by the growing contango in diesel futures contracts. There's a overall sense of worsening sentiment.”

Diesel is crucial for oil demand, as it is used in heavy industry, cars, and trucks.

According to the Energy Institute Review of World Energy, around 28.2 million barrels of diesel and similar product gasoil were used in 2022, out of a total oil demand of 97.3 million barrels a day that year.

However, there are indications of weak consumption of the fuel, even though this could be a period of weakness.

US demand for distillate fuel has averaged 3.66 million barrels a day so far in 2024, the worst start to a year since 2016, according to Energy Information Administration data.

In Europe, diesel sales have been declining as drivers move away from the fuel. French diesel sales dropped by 12% year-on-year in March, and recent data from Germany, Italy, and the UK also showed annual declines.

Even in China, weak local consumption is leading to increased exports. Diesel sentiment across Shandong, where teapot refineries produce the fuel, is weak.

The main reasons for the bearish diesel market include slow economic recoveries in major regions and a significant increase in diesel production capacity in Africa, the Middle East, and Mexico, according to analyst James Noel-Beswick at Sparta Commodities.

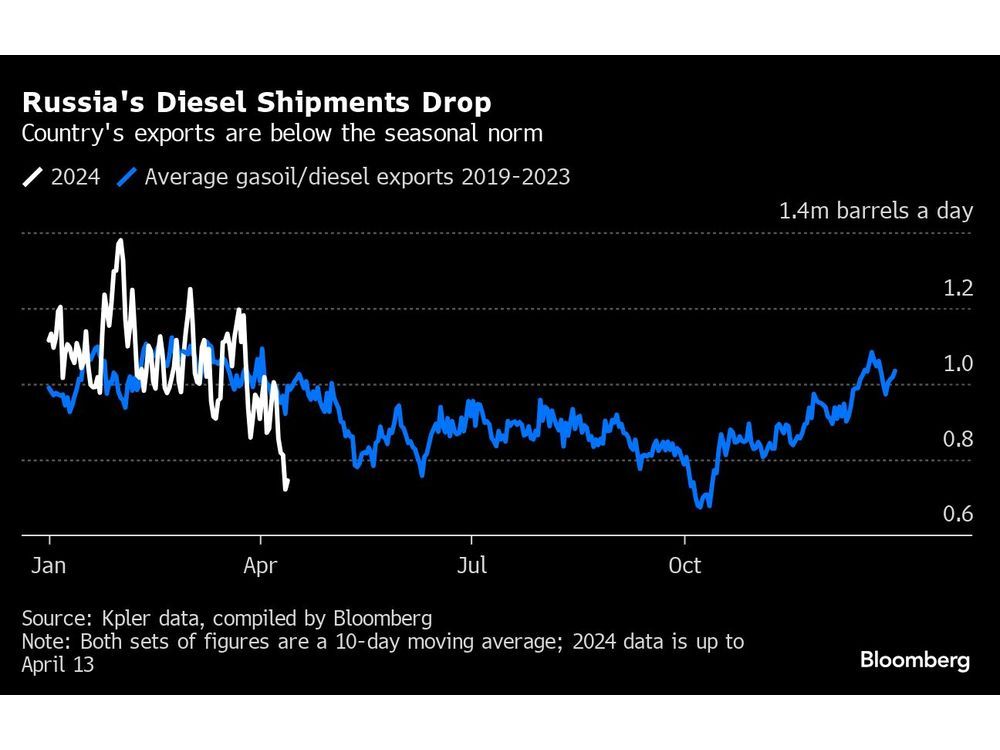

An indication of the market's weakness is how it has managed a supply slump from Russia, caused by Ukrainian drone strikes disrupting the nation’s oil refineries.

Data from analytics firm Kpler shows that Russian shipments averaged 740,000 barrels a day in the 10 days through April 13, a 25% decrease compared to the average between 2019 and 2023 at this time of year.

—With assistance from Serene Cheong.