The biggest U.S. sees an increase in jobs , the biggest in almost a year, increasing the likelihood Officials of the United States Federal Reserve are likely to postpone further the reduction of interest rates. from a two-decade high and consider fewer reductions this year than anticipated.

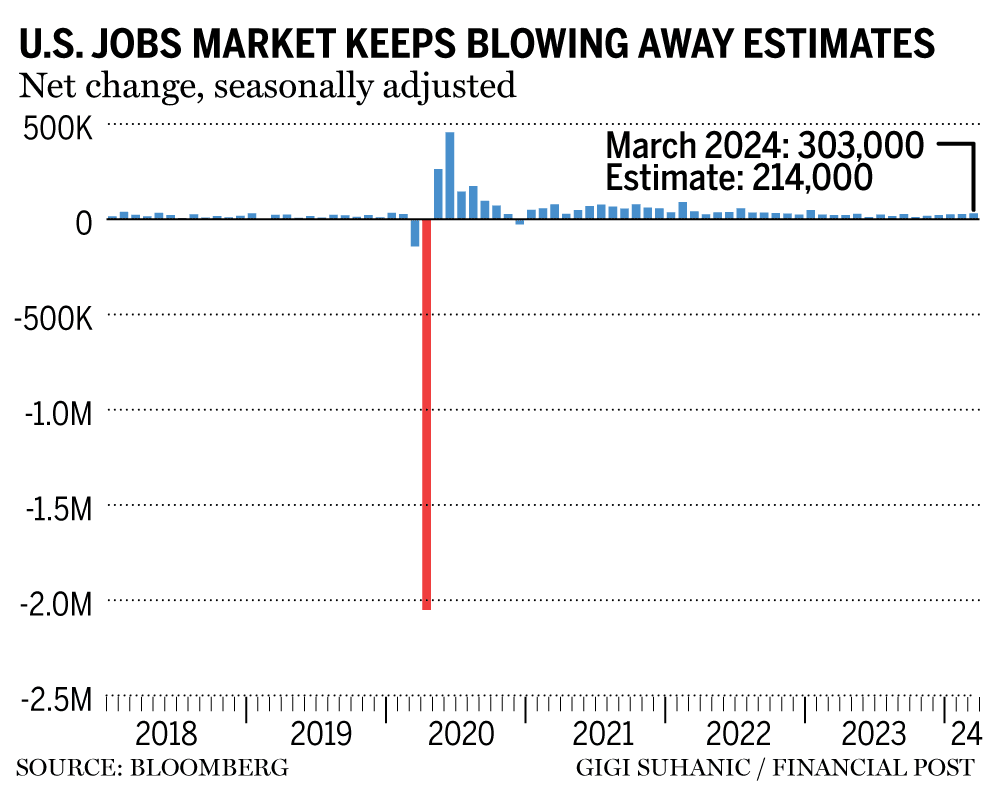

303,000 new jobs were added in March, surpassing expectations. The unemployment rate also decreased to 3.8 percent. Wages rose steadily, and more people joined the workforce, showing how strong the labor market is and its impact on the economy.

Chair Jerome Powell previously stated that strong hiring alone wouldn't delay rate cuts, but the latest figures, together with an increase in key inflation numbers at the start of 2024, might result in fewer or postponed cuts this year.

However, the situation could change as soon as next week with the upcoming inflation data influencing policymakers' decisions. New consumer price figures are to be released on Wednesday. upcoming inflation data in their decision-making process, and fresh consumer price figures are expected to come out on Wednesday.

Following the jobs report, traders lowered their bets on rate cuts in June or July, indicating a higher probability of less than three reductions this year, according to futures pricing.

Though Fed officials had planned for three rate cuts this year, the stronger-than-expected jobs report might prompt them to revise their projection to two reductions, starting in the second half of the year, according to Diane Swonk, chief economist at KPMG LLP.

- Canada's unemployment rate increases to 6.1% as job growth slows down

- Mohamed El-Erian believes this central bank shift could be historic

- CIBC predicts that the Bank of Canada will cut rates more significantly than the Fed

“This gives them the opportunity to wait and see if the early year inflation increase was just a blip or a larger issue,” said Diane Swonk. “They don’t want to reignite what they hoped would be a decrease in inflation.”

—With help from Molly Smith and Liz Capo McCormick.