Prime Minister Justin Trudeau announced measures to support renters’ rights and help them transition to homeownership as his government attempts to win back lost support among younger Canadians.

The measures would give tenants more rights in disputes with their landlords and ensure that rental payment history would count toward one’s credit score when applying for a mortgage.

It’s the first of several expected housing announcements ahead of Finance Minister Chrystia Freeland’s budget on April 16, as the Liberal government struggles to respond to soaring housing costs driven in part by Canada’s record population growth.

Trudeau is also attempting to turn around his poll numbers with young voters, who have been increasingly shifting their allegiance to his chief rival, Conservative Party Leader Pierre Poilievre.

“This is about protecting renters. But this is also about generational fairness – making sure millennials and Gen Z, who are most likely to rent, get a level playing field in the rental market,” the government said in a news release.

The news release acknowledged renters are currently facing “skyrocketing rents, renovictions, unfair competition and a lack of housing options.”

Bloomberg

To alleviate this, Trudeau announced a new $15 million Tenant Protection Fund that would fund legal aid organizations to contest “unfairly rising rent payments, renovictions or bad landlords.”

The prime minister also promised to create a Canadian Renters’ Bill of Rights that would create a nationwide standard lease agreement, and require landlords “to disclose a clear history of apartment pricing so renters can bargain fairly.”

Finally, Trudeau said he would ensure tenants get credit for on-time rent payments when they apply for a mortgage. “We’re going to amend the Canadian Mortgage Charter and call on landlords, banks, credit bureaus, and fintech companies to make sure that rental history is taken into account in your credit score,” the release said.

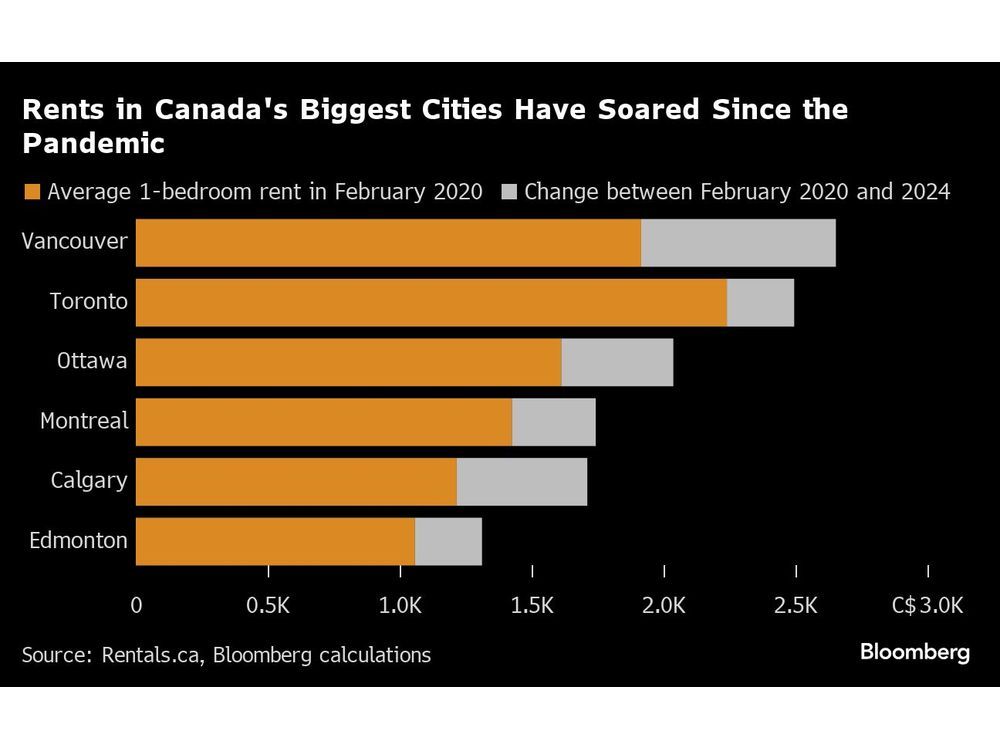

Asking rents for all residential property types in Canada averaged $2,193 in February, increasing 10.5 per cent year-over-year — the fastest rate of annual growth since September, according to the latest data from Rentals.ca.

The Canada Mortgage and Housing Corporation said Wednesday that apartment construction in Toronto, Vancouver, Calgary and Ottawa reached record levels in 2023, and that “purpose-built” rental units now account for about 42 per cent of apartment building starts in the country, above historical levels.

Construction began on a total of 98,744 apartment units in Canada’s largest cities last year, up 7.3 per cent from 2022, the report said. Still, the agency reiterated that demand for housing continues to outstrip supply across the country, and that the current trend in building and population growth suggests Canada will be short 3.5 million units in 2030.

With assistance from Erik Hertzberg and Jay Zhao-Murray.