Space company Redwire plans to continue growing and moving towards profitability by pursuing larger contracts for its components and developing a new satellite design.

Redwire's latest financial results show a revenue of $243.8 million in 2023, a 51.9% increase from 2022. Even without the contribution from QinetiQ Space NV, their revenue still grew 26.9%.

The company also reported positive adjusted EBITDA of $15.3 million, compared to an adjusted EBITDA loss of $11 million in 2022. Although they still had a net loss of $27.3 million in 2023, it was an improvement of $103.4 million over 2022.

During an earnings call on March 15, Redwire executives stated that the financial results validated their approach to the space market, where they acquired companies producing spacecraft components and used that as a foundation for future development.

Peter Cannito, CEO of Redwire, said, "Our heritage-plus-innovation strategy is effective. By focusing on the basic components of space, we are leading the growing demand of our customers."

Cannito mentioned the increasing demand due to reduced space access costs. He added, "Deploying space infrastructure is more affordable than ever. We continue to see key signs of a massive expansion of demand for space infrastructure." Demand comes from national security space activities, lunar exploration expansion, and general interest in low Earth orbit satellite constellations.

Cannito indicated that Redwire's future growth plans include growing demand for their current products and expansion into new markets. This involves "winning and fulfilling increasingly larger orders," such as the $142 million contract they secured in the fourth quarter to provide their Roll-Out Solar Array (ROSA) systems for an undisclosed satellite manufacturer.

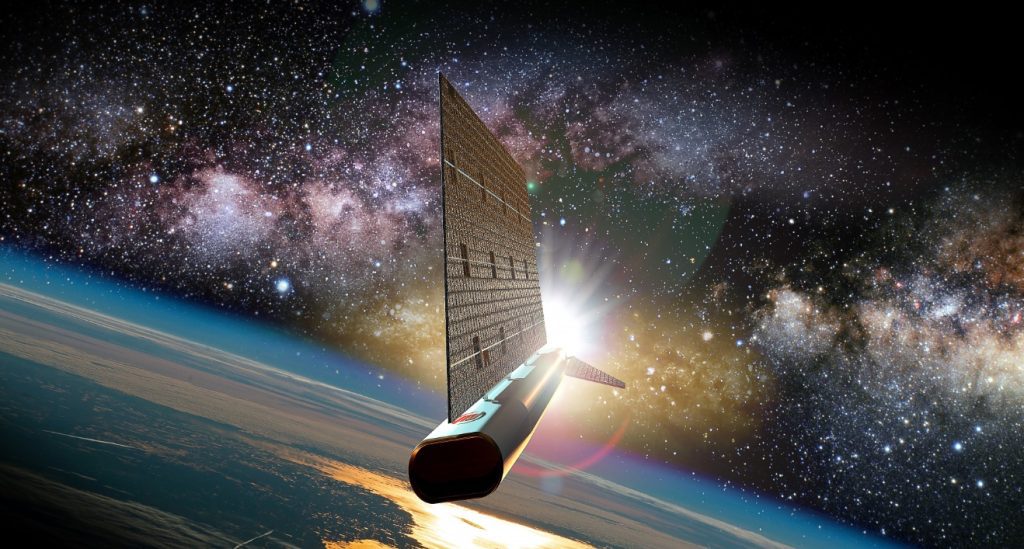

This contract follows another award from Blue Origin in January, the value of which was not disclosed. The award is to provide ROSA systems and other technologies for the Blue Ring transfer vehicle. Cannito stated, "With these two awards, we have started to increase our production capabilities while continuing to add to the heritage of our power generation offerings."Redwire is also aiming to move beyond being solely a component provider. Cannito announced that Redwire is developing a new satellite design called SabreSat for very low Earth orbit (VLEO) missions, which are gaining interest for providing reduced communications latency or improved imaging resolution due to their lower orbits, despite facing design challenges from greater atmospheric drag.

He said, "VLEO is vital for the future of defense and intelligence operations for the U.S. and its allies. We are providing customers with an innovative approach to explore an advanced orbital platform." Specific details about SabreSat, including its performance and readiness for flight, were not disclosed.

Cannito said that SabreSat is just one example of how the company is looking for opportunities to move to higher-value activities by creating unique next-generation spacecraft that will fill gaps in the market for future space infrastructure. Redwire will also look for opportunities in new markets, like microgravity research, that have the potential to make a big impact.

The company predicted it would make $300 million in revenue in 2024. There was no forecast for earnings or cash flow for 2024.

Redwire, a space infrastructure company, plans to continue growing and aiming for profitability by pursuing larger contracts for its component lines while moving up the value chain, which includes a new satellite design.