Between 2018 and 2022, numerous large U.S. companies compensated their top executives with more money than their federal tax payments, a recent study by the progressive Institute for Policy Studies (IPS) and Americans for Tax Fairness (ATF) discovered.

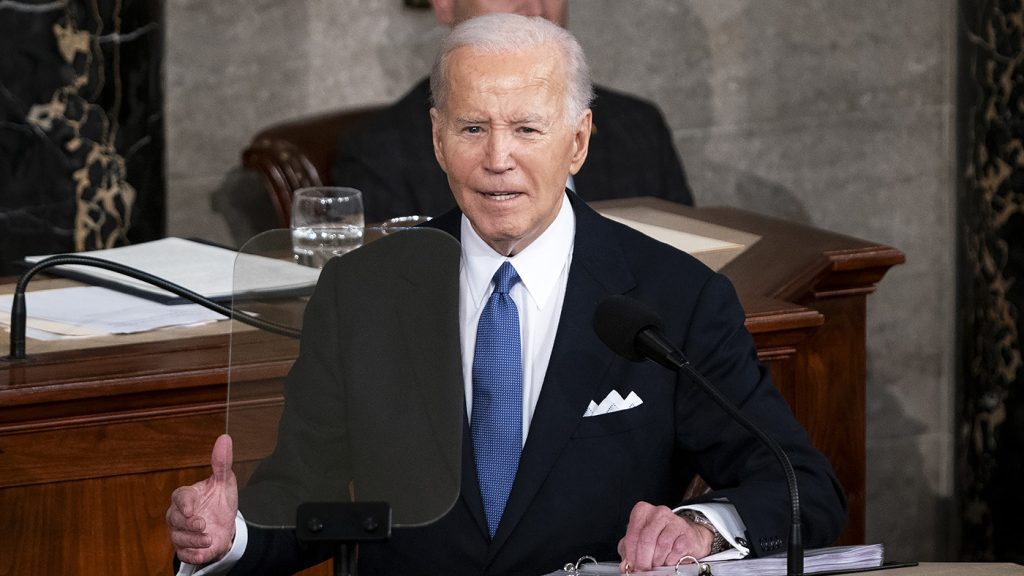

The report is released as President Biden has suggested increasing the corporate tax rate to 28 percent, up from the 21 percent rate established in 2017 by his predecessor and likely 2024 presidential rival, former President Trump, under the Tax Cuts and Jobs Act.

The analysis by IPS and ATF, which examines tax and compensation for the initial five years after Trump’s tax cuts came into effect in 2018, seeks to link generous compensation packages offered to top executives of large corporations to the decreased tax rate.

During at least two of those five years, 64 companies compensated their top five executives more than what the business paid in federal taxes, according to the analysis. Of those companies, 35 — such as Ford and Tesla — compensated their top executives more than their total tax payments over all five years.

The analysis revealed that the total compensation for the top executives at those 35 companies amounted to $9.5 billion over the five-year period, while their combined federal income taxes added up to negative $1.8 billion.

“Both types of corporate misconduct — paying too little in taxes and overcompensating executives — ultimately harm working families by reducing their pay and reducing public services,” stated David Kass, executive director of Americans for Tax Fairness.

Many corporations manage to pay lower tax rates than those set under the Trump tax bill by making use of various tax breaks and loopholes. The average effective tax rate for large, profitable companies dropped to 9 percent in 2018 from 16 percent in 2014, according to a 2022 analysis by the Government Accountability Office.

Biden’s proposal, which also included higher taxes on individuals with a net worth over $100 million, is highly unlikely to be approved by the Republican-controlled House.

The president’s plan also faced strong criticism from the U.S. Chamber of Commerce, the significant pro-business lobbying group that allocated nearly $70 million for federal lobbying in 2023, the most of any interest in Washington.

Neil Bradley, the organization’s chief policy officer, informed CBS News that although they had not seen the study, “it sounds like something done by people with a political agenda who don’t understand how our tax system works.”

“Companies pay taxes on their profits after their expenses. If a company doesn’t make a profit, or if it reinvests its earnings into building a new plant or paying employees higher wages, then there are no profits after expenses on which to be taxed,” Bradley explained.

The Hill has reached out to the Chamber of Commerce, Ford and Tesla for comment.

The issue of how to tax wealthy corporations and individuals is expected to be a key part of the upcoming presidential election, as many provisions in the 2017 tax law are set to expire in 2025.

During his speech last Thursday, Biden stated that he wants to increase the corporate tax rate in order for every large company to eventually contribute their fair portion.

Biden expressed that the key to achieving fairness in the tax system is to ensure that major corporations and the extremely wealthy start paying their fair share.