The cost of health insurance keeps increasing, and many workers have high-deductible plans, meaning they have to pay $100 or more for a doctor's visit.

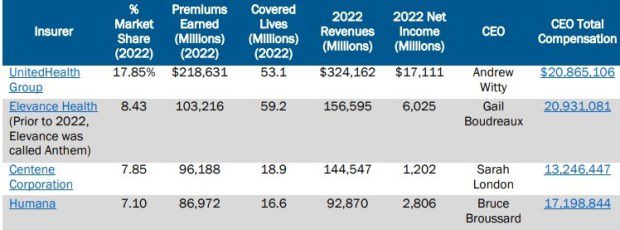

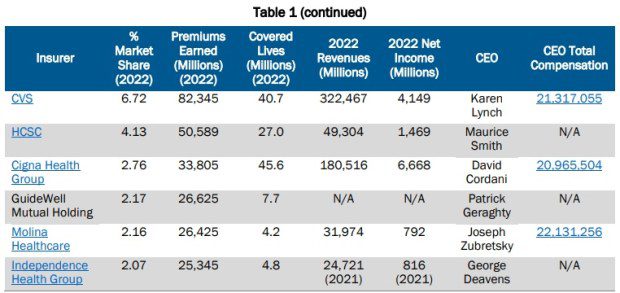

In 2022, the CEOs of the top 10 health insurance companies were paid between $13 million and $22 million in total compensation, including salary, bonuses, and other pay, as stated in a report from the Connecticut Office of Legislative Research. This report was issued on Feb. 5.Meanwhile, these 10 companies cover over 60% of the commercial health insurance market.

The largest company, UnitedHealth Group, covers almost 18% of the market, accounting for 53 million people. Its CEO, Andrew Witty, earned $20,865,106 in 2022.

However, Joseph Zubretsky, CEO of Molina Healthcare, was paid $22,131,256, even though his company covers only 2.16% of the market and 4.2 million people.

In 2022, UnitedHealth Group had $324 billion in revenues, while Molina Healthcare had just under $32 billion.

Sean King, acting state healthcare advocate, commented, saying that the high executive compensation doesn't seem fair, especially when many Americans are struggling with medical debt and emergency expenses.

He pointed out that over 40% of adults in America are unable to pay off their medical debt, and a third of Americans can't cover emergency expenses of $400 or more.

A detailed public document called a proxy statement is filed by publicly traded companies before shareholder meetings. It's over 100 pages long and provides information so that stock owners can make informed votes.

The executive compensation program at UnitedHealth includes a mix of base salary, annual cash incentives, stock compensation awards, and broad-based benefits. The aim is to attract and retain highly qualified executives.

The company reported that 94% of the votes cast at the 2022 Annual Meeting of Shareholders were in favor of their executive compensation program.

The second-highest paid CEO is Karen Lynch, earning $21,317,055, with a market share of 6.72% and 40.7 million people covered. CVS CVS Caremark

CVS Caremark has a third of the market share, filled 2.3 billion prescriptions in 2022, and brought in $169 billion in revenue. The other two pharmacy benefit managers in the top three are Express Scripts(Cigna) and OptumRX(UnitedHealth Group).

CVS spokesman Ethan Slavin stated that the majority of Ms. Lynch’s compensation is tied to company performance, with less than 10% being her fixed base salary.

King expressed concern about the large CEO compensation and questioned what motivates them. He suggested that instead of focusing on maximizing shareholder returns, they should be incentivized to reduce healthcare costs and improve outcomes.

Next on the list are David Cordani of Cigna Health Group, who received $20,965,504, Gail Boudreaux of Elevance Health, previously known as Anthem, who was paid $20,931,081 in 2022, Bruce Broussard of Humana, whose compensation was $17,198,844, and Sarah London of Centene Corp., who received $13,246,447.

The compensation packages for Maurice Smith of Health Care Service Corp. and Patrick Geraghty of GuideWell were not available.

“The system is really broken,” said Michael DeLong, research and advocacy associate with Consumer Federation of America. “In theory, CEOs’ pay should be based on their performance, but in reality, especially insurance company CEOs, live lavishly while raising insurance premiums, which particularly affects those living paycheck to paycheck.”

DeLong noted that health insurance CEO compensation is even higher than property and casualty insurance. He believes the issues are more severe in these cases.

DeLong suggested that state insurance regulators need to scrutinize the issue more closely and should be skeptical of insurance companies' claims to raise rates while giving large increases to CEOs and senior executives.

He mentioned that insurance regulators are often understaffed and lack expertise in protecting consumers, which he referred to as “regulatory capture.”

According to DeLong, insurance regulators are not focused on protecting consumers and have strong incentives to keep the industry happy to secure lucrative job opportunities after leaving their regulatory positions.

Largest Health Insurers by Total Market Share Covered Lives, Revenue, Net Income, and Executive Compensation by Total Market Share (2022) Part 1

Ed Stannard can be reached at [email protected].