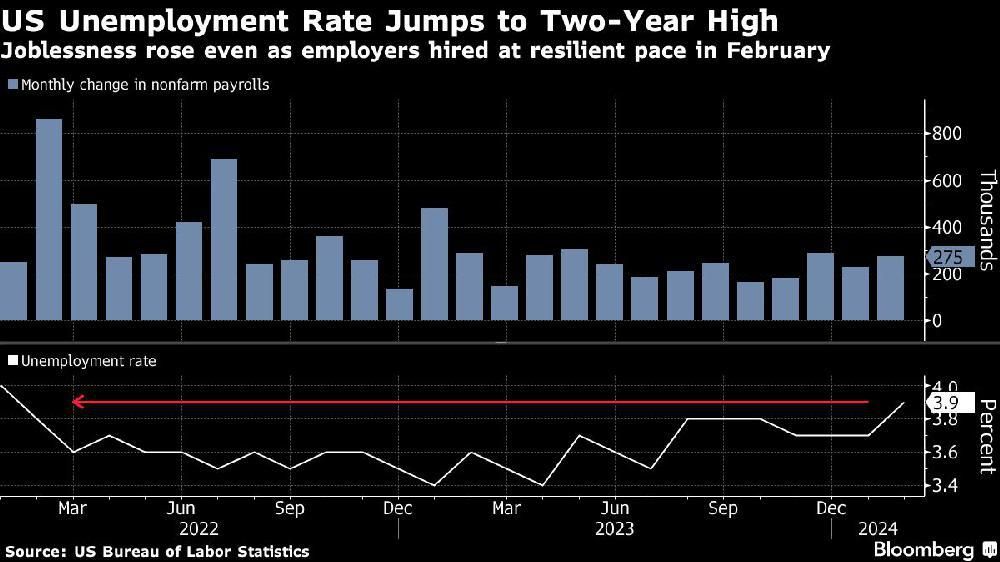

In February, the unemployment rate in the U.S. went up to its highest level in two years, while the rate of hiring stayed strong, indicating that the job market is cooling down but still strong.

According to a report from the United States Bureau of Labor Statistics (BLS) on Friday, non-farm payrolls increased by 275,000 last month, but there was a downward revision of 167,000 for the previous two months. The unemployment rate went up to 3.9 per cent and wage gains slowed.

The report shows that the job market is gradually slowing down, with less strong job and pay gains, suggesting that the economy will keep growing without a high risk of speeding up inflation. The report shows that the job market is gradually slowing down, with less strong job and pay gains, suggesting that the economy will keep growing without a high risk of speeding up inflation.This situation gives the U.S. Federal Reserve policymakers the opportunity to reduce interest rates this year. The numbers for payrolls and wages come from a survey of businesses and other employers, while the unemployment numbers come from a smaller survey of households. The smaller survey showed an increase in the number of unemployed workers. The data revealed that some of the increase in the unemployment rate was due to more people entering the job market and not immediately finding work.

Jobs in February were mainly created in service-providing sectors such as health care, leisure and hospitality, and the government, according to the BLS survey.

After the release of the figures, the S&P 500 went up, while short-term Treasury yields and the U.S. dollar both decreased. Traders are now more certain about a cut in interest rates in June.

Traders are now more certain about a cut in interest rates in June.

Traders are now more certain about a cut in interest rates in June. The continued strong job creation and moderate wage increases are enabling consumers to continue spending, despite facing higher borrowing costs and prices. There has been a gradual, but uneven, increase in the number of people joining the job market, which has reduced some of the tightness in the job market.The Federal Reserve officials are closely monitoring the job market and its impact on consumer spending as they evaluate the path of inflation. They have indicated that they are not in a hurry to lower interest rates, partly because of the gradual cooling in the job market.

In a testimony before Congress on Wednesday, Fed chair Jerome Powell said, “We’re seeing a labour market that is still tight, still strong, wages are moving up. And we’re trying to use our policies to keep that growth going and to keep that labour market strong, while also achieving further progress on inflation.”

Fed impact

Another important point is the relationship between the supply and demand of workers and its impact on wages. Average hourly earnings increased by 0.1 per cent from January and 4.3 per cent from a year ago. The moderation in wage growth follows a large increase in the previous month, which some economists attributed to extreme weather.

This is the final monthly jobs report that Fed officials will have before they meet on March 19-20. Economists expect officials to keep interest rates steady as they wait for more progress on inflation.

“The February jobs report doesn’t indicate a recession. But it does suggest that the Fed is getting closer to achieving its goal of slowing down the hot job market that led to high inflation,” said Bill Adams, chief economist at Comerica Bank, in a note.

Meanwhile in his address on Thursday, U.S. President Joe Biden proudly talked about the strong job market and manufacturing employment during his time in office.

The employment report seems to indicate a gentle economic slowdown, according to Julie Su, the acting Labor Secretary, in an interview on Bloomberg Television.

Canada's job gains are twice as much as expected, but the unemployment rate goes up

'Economists say the jobs data is unlikely to have much impact on the Bank of Canada'

- U.S. basic inflation exceeds predictions, likely pushing back any potential interest rate cuts by the Fed

- The employment report also indicated that the participation rate — the percentage of the population that is employed or actively seeking employment — remained at 62.5 per cent. However, the rate for workers aged 25-54 rose to a five-month high of 83.5 per cent.

- Despite an increase in the unemployment rate, the job market continues to be strong

The jobs report also showed the participation rate — the share of the population that is working or looking for work — held at 62.5 per cent. The rate for workers age 25-54, however, climbed to a five-month high of 83.5 per cent.