A recent study conducted by researchers from Zurich found that a ‘super entity’ of 147 companies controls 40% of the entire corporate network.

The work is quite controversial, as some assumptions were made in order to complete the study – and these assumptions were challenged by some. However, most complex system analysts claim that the work is a remarkable effort to untangle control in the global economyş taking the study one step further could lead to finding ways of improving capitalism.

The idea that a few groups of banks control the global economy is not new to many, but for the first time, this study has moved from ideology to identifying this network of power.

“Reality is so complex, we must move away from dogma, whether it’s conspiracy theories or free-market,” says James Glattfelder. “Our analysis is reality-based.”

Using data from Orbis 2007, a database listing 37 million companies and investors worldwide, they pulled out all 43,060 TNCs and the share ownerships linking them. After this, they constructed a model of which companies controlled which, through shareholding networks, as well as company revenues – to map the financial power.

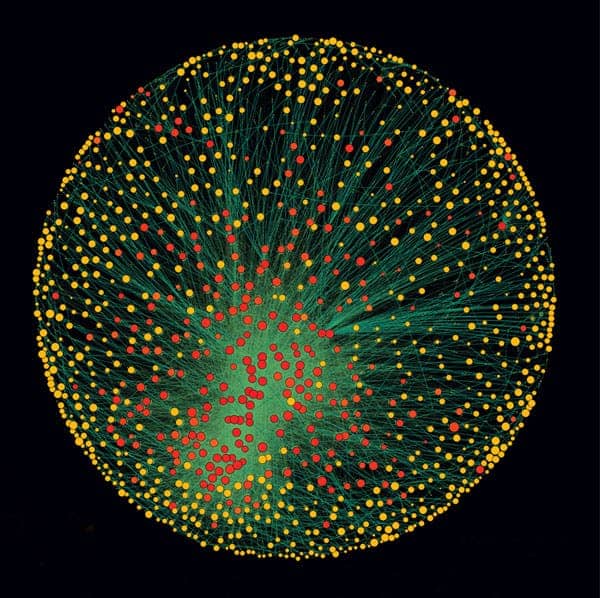

The work, which will be published in PLoS revealed a core of 1318 companies with interlocking ownerships (see image). Each of the 1318 had ties to two or more other companies, and on average they were connected to 20. When they took it one step further, and untied the web even more, they found that a “super-entity” of 147 closely bound companies controlled 40% of the money in the network.

John Driffill of the University of London, a macroeconomy expert says that this not only shows how a small group is in control, but that it gives extremely valuable insights on world stability. The concentration of power is neither good nor bad in itself, but how the connection between this small group and others work – this can be both good and bad.

“It’s disconcerting to see how connected things really are,” agrees George Sugihara of the Scripps Institution of Oceanography in La Jolla, California, a complex systems expert who has advised Deutsche Bank.

When you think of it, the most important thing that could be derived from this study is how we can find ways of increasing stability in the financial world by understanding its architecture. By finding the weak spots, they can be improved. Glattfelder says we may need global anti-trust rules, which now exist only at national level. However, the study doesn’t feed those believing in global conspiracies, as it explains that the apparition of such a structure occures rather naturally, and not as a result of some plan to rule the world:

“Such structures are common in nature,” says Sugihara.

Here’s a list of 50 of those 147 companies.

1. Barclays plc

2. Capital Group Companies Inc

3. FMR Corporation

4. AXA

5. State Street Corporation

6. JP Morgan Chase & Co

7. Legal & General Group plc

8. Vanguard Group Inc

9. UBS AG

10. Merrill Lynch & Co Inc

11. Wellington Management Co LLP

12. Deutsche Bank AG

13. Franklin Resources Inc

14. Credit Suisse Group

15. Walton Enterprises LLC

16. Bank of New York Mellon Corp

17. Natixis

18. Goldman Sachs Group Inc

19. T Rowe Price Group Inc

20. Legg Mason Inc

21. Morgan Stanley

22. Mitsubishi UFJ Financial Group Inc

23. Northern Trust Corporation

24. Société Générale

25. Bank of America Corporation

26. Lloyds TSB Group plc

27. Invesco plc

28. Allianz SE 29. TIAA

30. Old Mutual Public Limited Company

31. Aviva plc

32. Schroders plc

33. Dodge & Cox

34. Lehman Brothers Holdings Inc*

35. Sun Life Financial Inc

36. Standard Life plc

37. CNCE

38. Nomura Holdings Inc

39. The Depository Trust Company

40. Massachusetts Mutual Life Insurance

41. ING Groep NV

42. Brandes Investment Partners LP

43. Unicredito Italiano SPA

44. Deposit Insurance Corporation of Japan

45. Vereniging Aegon

46. BNP Paribas

47. Affiliated Managers Group Inc

48. Resona Holdings Inc

49. Capital Group International Inc

50. China Petrochemical Group Company

![Study finds capitalist network of companies runs the world [with list] – 201110interconnected](https://www.plazajournal.com/wp-content/uploads/2024/02/201110interconnected.png)